Earlier this year, I spent two weeks on the ground in India meeting with over 40 corporate and political contacts. The major themes that emerged from the discussions were related to Semi Urban Rural (SURU) developments, the rise of domestic manufacturing clusters, and an underappreciated energy transition. The trip reinforced our belief that India offers an abundance of attractive, long-term investment opportunities among undervalued and often overlooked companies1i– perhaps surprising to some given its position as the world’s largest democracy (and most populated country).

Why travel to India?

Our emerging markets equity strategy has meaningful exposure to India from both an absolute perspective (15.6%) and relative to the MSCI Emerging Markets Index (+196 bps)2, and this has been the case – and a source of our differentiation – since launching the strategy in 2021. We have also been purchasing Indian companies in our global and international portfolios, now representing 1.4% and 1.9%, respectively2. We expect India to grow faster than emerging markets as a whole in 2023, driven primarily by domestic forces – these are easier to observe and assess when spending time on the ground surrounded by the locals. While broad market valuations appear expensive, we are finding plenty of bottom-up, unique investment opportunities that are underappreciated by investors with less contrarian tendencies. The trip gave me a chance to observe and experience evolving market dynamics first-hand and probe into key questions with our local contacts throughout the Indian ecosystem.

What were our first impressions?

Clean and tidy are typically not the words that come to mind when visiting India. For the first time in over 13 years, I was met by clean sidewalks and streets in Delhi as well as more organized and well-developed roads in Mumbai. The locals seemed equally pleased by the improved and clean(er) infrastructure, with several commenting that certain upgrades appear to have happened overnight. Positive infrastructure developments in cities, and increasingly in rural areas, have been driven by two key factors – one situational and one more systemic. First, in preparation for hosting several G20 meetings, municipal governments worked to beautify select areas to impress dignitaries from other nations. Second, and perhaps more importantly from a long term investor’s standpoint, the pandemic prompted a period of reverse migration, pushing the population away from cities and into more rural areas. Now that more work can be done remotely, many individuals have not returned to urban centers. This has prompted an increased need for rural development, creating more demand for local workers. These changes in how and where people are working will begin to shift the balance away from primarily agrarian communities. This could generate improvements in the health of rural economies and unlock company-specific investment opportunities.

What are the key takeaways from our trip?

a. SURU Rising – The message in company meetings across the consumer durables, industrials, and financial services industries was consistent: increasing demand for products and supplies to support SURU development projects. Some areas mentioned frequently include irrigation, electrification, infrastructure, and consumption (typically financed by Indian banks).

b. Made in India – Indian companies are capitalizing on recently announced Production Linked Incentives (PLIs) meant to increase domestic production. In addition to creating demand for a local supply chain, the overall competitiveness and efficiency of Indian businesses should also improve. Over time, we expect to see India competing with other ASEAN countries as a potentially attractive end market for foreign investments linked to China Plus One3 strategies.

c. Green Energy Transition – The Indian government and corporations are embarking on an ambitious green energy transition plan. The goal in the public sector is to increase natural gas’ share of total energy consumption from 6.5% to 15% by 2030. This policy objective should drive increased volume demand, providing support for operators across the gas supply chain to expedite related infrastructure projects, and companies within the energy supply chain and the utilities industry should be beneficiaries of these new government policies. Meanwhile, private sector companies are capitalizing on the shift by developing modern green energy manufacturing capabilities and/or producing renewable energy equipment for domestic and international markets.

What excites us in India?

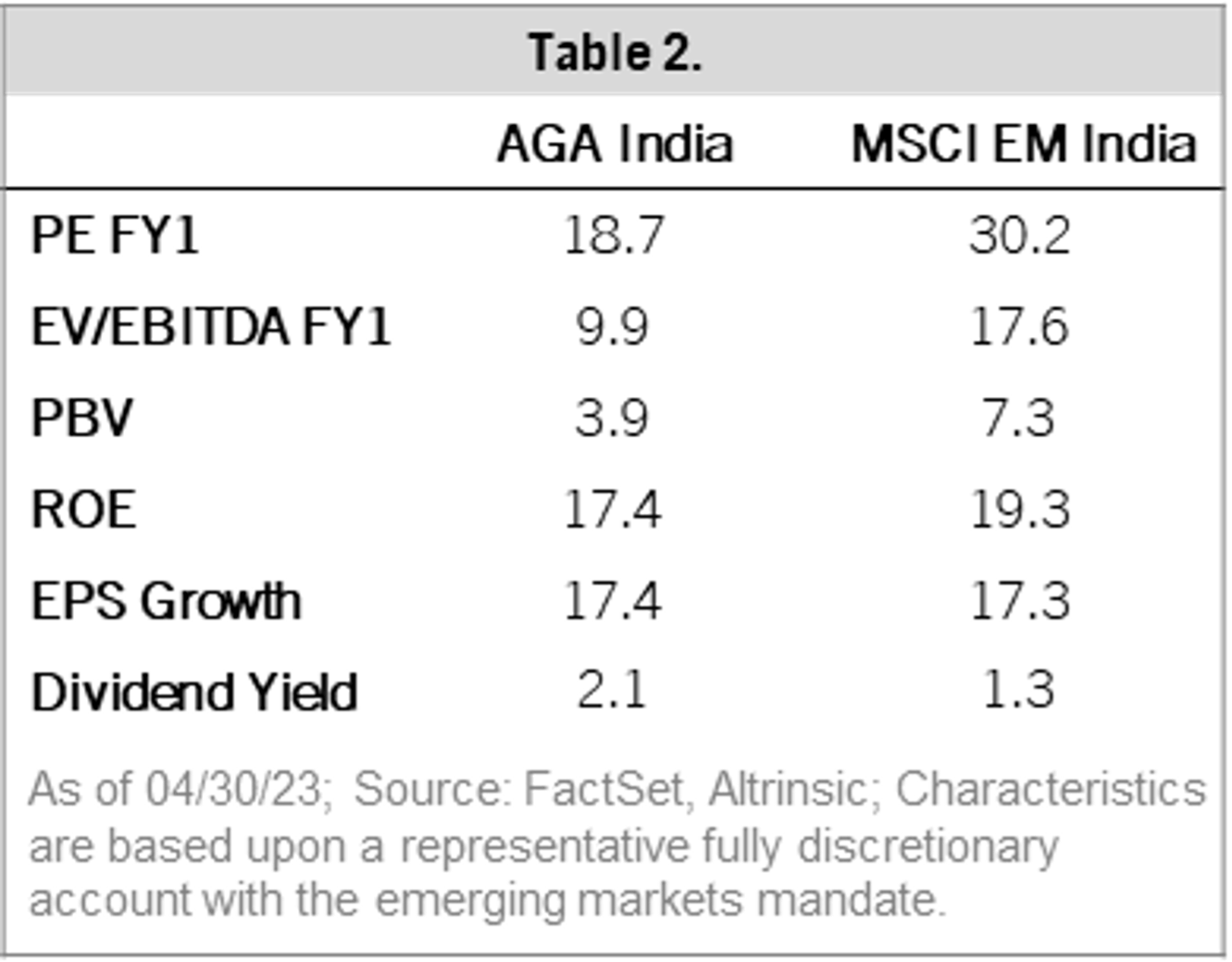

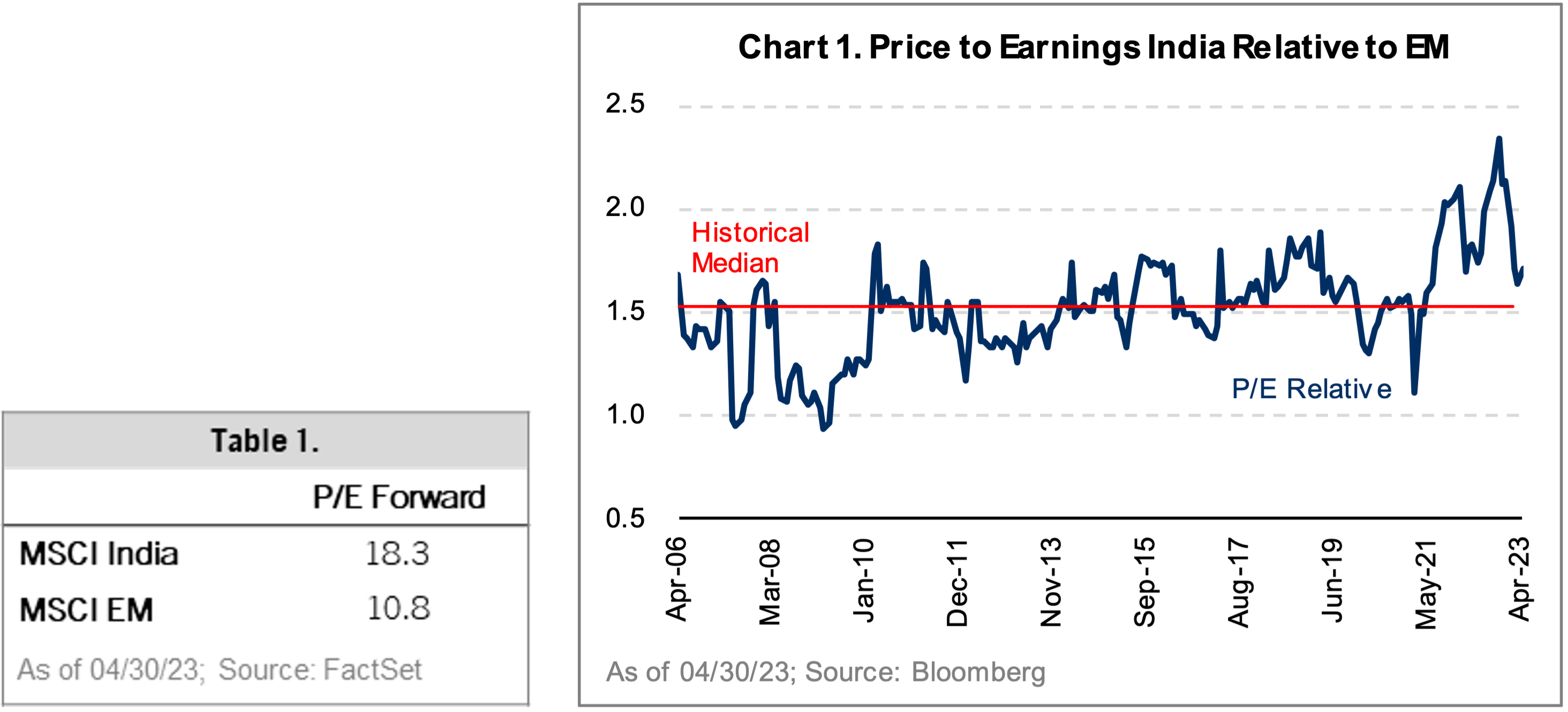

From a simplistic perspective, India appears expensive (Table 1 & Chart 1). However, after spending time on the ground and analyzing the market from the bottom up, we are enthusiastic about the opportunities present in this market.

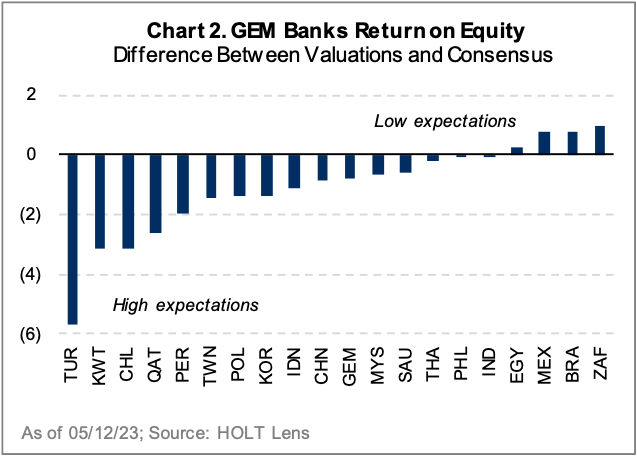

High-quality private banks such as HDFC and Axis Bank have long runways to capitalize on rising SURU demand for credit. Expanding into new rural markets with the same standards of prudent underwriting and no compromise on cost efficiency provides an attractive path to high levels of sustainable ROE. Both of these banks are attractively valued compared to similar quality banking franchises in other emerging markets (Chart 2).

In the consumer segment, our visit with ITC, India’s leading tobacco and consumer staples company, confirmed our belief that the market is vastly undervaluing the company’s highly profitable and growing food business. Leading branded food companies, including Nestle India and Hindustan Unilever, trade at substantially higher valuations despite similar return profiles. We also see an opportunity for ITC to unlock value across its portfolio of hotel assets. Reliance Industries, a large conglomerate with assets spanning from communication services to retail to energy, should benefit from the green energy transition underway. The company is investing heavily to transform its energy business and create a modern green energy manufacturing base to support its assets with renewable power. Additionally, Reliance is taking advantage of government policies and PLI schemes to produce renewable energy equipment for domestic and international markets. Once fully executed, Reliance will have the world’s most integrated renewable energy value chain.

City gas distribution companies, including Indraprastha Gas Ltd., will also benefit from the transition to green energy. Meetings with the company’s senior leadership team reinforced our views about the expected benefits from policy measures (volume demand-driven) as well as their access to lower-cost domestic feedstock.

What are the key risks in India?

We are enthusiastic about the long-term opportunity in India but recognize the potential for volatility from several sources:

1. Politics – The current Modi administration can be credited with many business-friendly policies. We believe this record of success should continue regardless of who wins next year’s general elections but recognize that priorities can change.

2. Global Economic Slowdown – India has strong domestic macro underpinnings, but a weaker global economy may impact the pace of growth. However, this will likely be offset by the implicit lower demand (and price) for crude oil, where India is a net importer.

3. Governance – Many companies are behind in their discourse and disclosure on corporate governance, and the Adani episode has not helped. Based on our decades of experience investing in India, we don’t believe this is a systemic issue, and our engagements over the years have been helpful. We are encouraged by smaller companies’ improvements in this area, and we firmly believe greater internationalization of the Indian market will accelerate change for the better.

What are the investment implications?

Our bottom-up portfolio construction approach has resulted in a meaningfully differentiated exposure to India – both from an overall perspective (relative overweight versus the benchmark) and from a sector perspective (allocations vary markedly from the benchmark). This result reflects our willingness to be contrarian and highlights the attractive discounts to intrinsic valuations that we are finding in the Indian market (Table 24). As we continue to look for opportunities to capitalize on evolving domestic and global dynamics (including changing consumption patterns, rural growth, domestic capex and manufacturing growth, and the green energy transition, among others), our goal is to find the underappreciated and undervalued companies fueling the changes and/or poised to benefit.